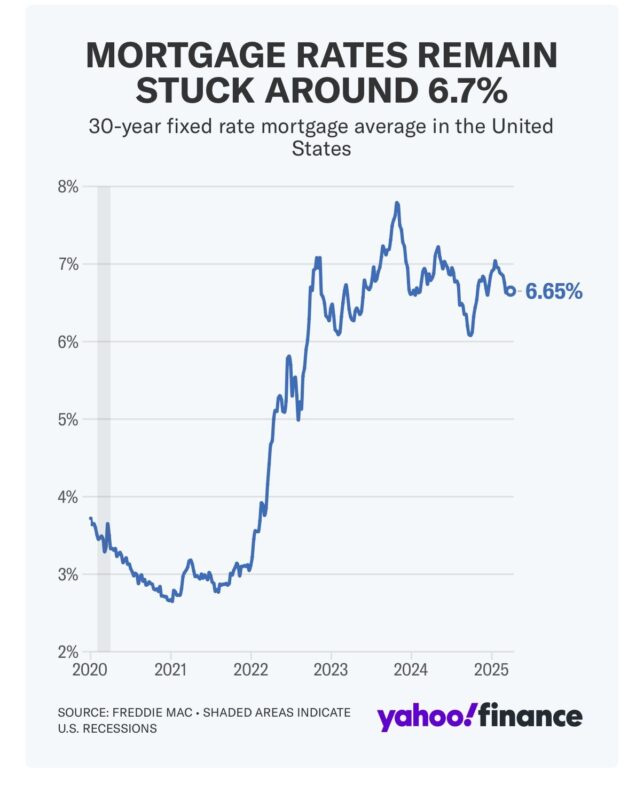

Seems like we are bumping along sideways for the moment in the mortgage landscape.

As of April 1st, 2025, we’re locking FHA loans deep into the 5s with great credit, and it’s feeling like a steady groove.

Table of Contents

Current Rate Environment

Right now, on April 1st, FHA loans are holding steady in the mid-to-high 5% range for those with stellar credit.

It’s not the rock-bottom rates of yesteryear, but it’s a workable spot. The explosion in application volume we’re seeing suggests buyers are done waiting—they’re adjusting to this reality.

From first-timers to repeat buyers, folks are making it work. But will this sideways trend stick around, or are we due for a shake-up?

Post-Friday Report

Friday’s report is the big wildcard coming up, and it’s got everyone’s attention. Inflation is just sticky right now—not surging, but not exactly fading fast either.

My take? We’re likely to see rates hover in this 5% to 6% zone for FHA loans through April unless that report throws us a curveball.

If inflation shows signs of cooling, we might dip toward the low 5s, but I’m not holding my breath for a big drop yet.

Conclusion

So, as of April 1st, 2025, rates aren’t budging much, but the market’s showing it can roll with the 5s.

Buyers are diving in, applications are through the roof, and investment plays are heating up.

Curious how this could work for you—whether it’s a purchase or refinance? Give me a call! I’d love to talk through some scenarios and figure out how to make these rates click for you.

Let’s connect and run the numbers together!

Contact Information

To learn more about the Mortgage Investors Group National Affinity Program or to begin the pre-qualification process, please contact:

Adam Buice

Loan Officer NMLS #1619090 MIG NMLS #34391 404-416-6380

[email protected]

www.AdamBuice.com